Leading global real estate consultancy, Knight Frank Middle East unveils its latest research findings showcasing a significant surge in transactional activity in Abu Dhabi’s office market during the first half of 2023. This remarkable growth reflects the city’s commitment to economic diversification and serves as a powerful catalyst in boosting investor confidence.

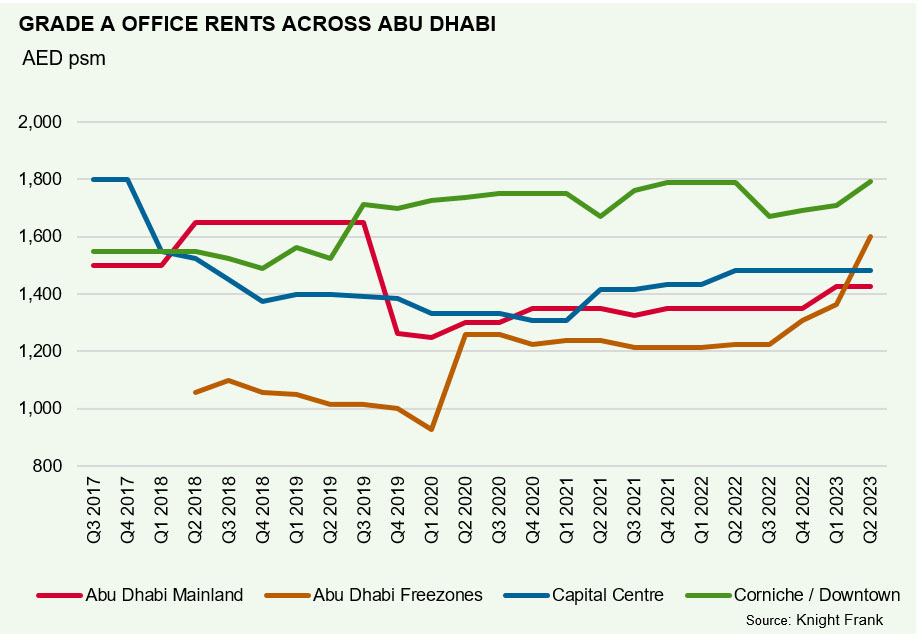

According to Knight Frank’s Abu Dhabi Office Market Review – Summer 2023 average rents within Abu Dhabi Freezones, which now includes Al Reem Island, have risen by 31% over the past 12 months, reaching AED 1,600 per square metre, driven by a combination of increased demand from businesses expanding their operations and a limited supply of available commercial space.

At a submarket level, Grade A office rents in Corniche / Downtown (AED 1,800 per square meter) have remained virtually unchanged over the same period, however, have risen by 4% since January 2020.

Demand for offices remains robust, fuelled by both local enterprises and international businesses seeking to establish or expand their presence in the capital.

Andrew Love, Partner and Head of ME Capital Markets and OLSS, states, “In the first six months of this year alone, commercial office sales transactions rose to AED 1.3 billion, representing a 220% increase in sales transactions compared to the same period last year. Notably, almost 70% of these transactions in 2023 took place on Al Reem Island and Al Maryah Island, amounting to a combined total of AED 919 million, driven by the availability of Grade A supply which remains highly sought after, but very short supply across the city and also by the recent announcement of ADGM’s expansion.”

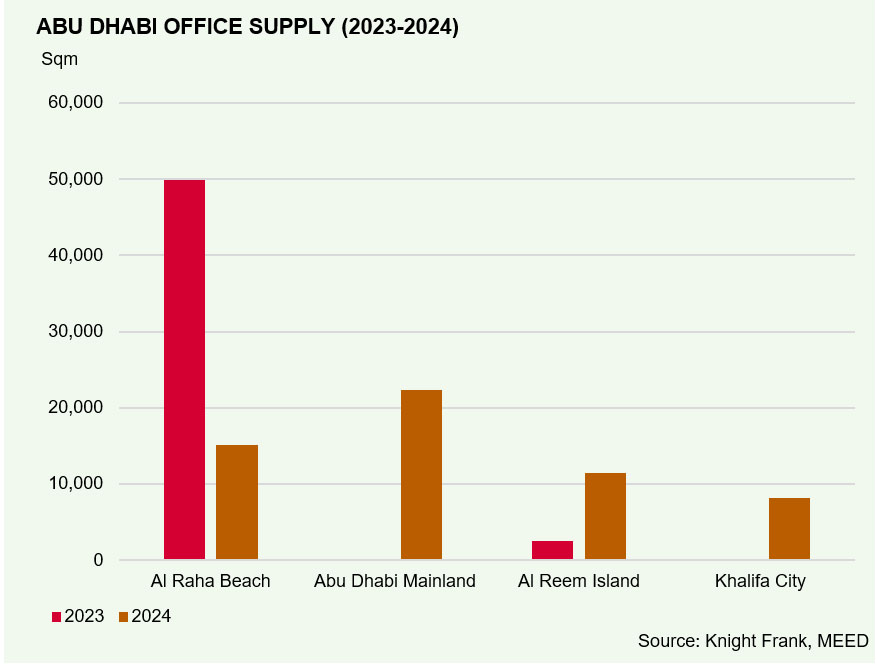

Looking ahead, Abu Dhabi’s office market is set to welcome an estimated 109,500 square metres of additional office space within the next two years. This supply is spread across Al Raha Beach (65,060 square metres), Abu Dhabi mainland (22,350 square metres), Al Reem Island (13,960 square metres) and Khalifa City (8,200 square metres).

Separately, Aldar Properties and Mubadala’s recently announced JV at ADGM is expected to add a further 63,000 sqm of office space in a 37-storey tower by 2026. However, the project remains classed as “launched” as construction is yet to commence.

Faisal Durrani, Partner and Head of Middle East Research, added: “Investors have tuned into the rising tide of demand for best-in-class space and are moving to capitalise on this demand from occupiers. For now, occupiers driving the 79,000 square meters of new demand we have recorded in the first half of 2023 are starved of options. Unsurprisingly, this is further exacerbated by the fact that Grade A occupancy levels have edged up to 92%, from 88% at the end of last year, highlighting the growing supply-demand imbalance. The key is to deliver high quality, Grade A, ESG-rated offices, which occupiers are gravitating towards the world over, not least because of the role best-in-class offices play in talent attraction and retention, as well as meeting ESG obligations.”

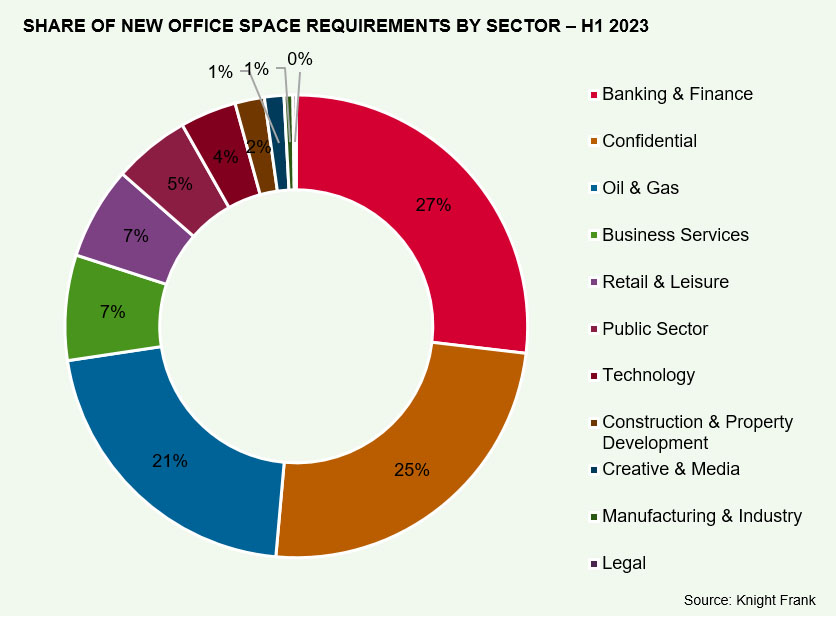

Knight Frank says, consistently aligning with past demand patterns, the banking and finance, oil and gas, and business services sectors have emerged as the leading sources of demand. Of the 79,000 square metres of new requirements, the banking and finance sector accounts for 27%, closely followed by the oil and gas sector at 21%. Business services is ranked as the third-largest source of requirements, constituting 7% of the total demand.

In response to growing demand, the Abu Dhabi Global Market (ADGM) financial free zone has expanded to Al Reem Island, adjacent to its current home on Al Maryah Island, growing its land area 10 times greater than its current footprint to 14.4 million square metres.

David Crook, Head of Abu Dhabi, concludes, “The extension of ADGM’s jurisdiction to Al Reem Island will offer welcome relief to the supply-starved market. This expansion also aligns with the Growth Strategy 2023-2027, aimed at positioning Abu Dhabi as a leading global city with a thriving financial sector that significantly contributes to its GDP.”

Highlighting the benefits of the expanded jurisdiction, Crook states, “Businesses within the financial-free zone can take advantage of a preferential corporate tax rate of 0% on their qualifying income. This enticing incentive serves to further stimulate growth and investment, amplifying the appeal of Abu Dhabi as a preferred business destination.”