The Abu Dhabi Government has unveiled a comprehensive package of financial incentives, in line with the directives of His Highness Sheikh Mohamed bin Zayed Al Nahyan, Crown Prince of Abu Dhabi, Deputy Supreme Commander of the UAE Armed Forces and Chairman of the Abu Dhabi Executive Council.

A collective effort by Abu Dhabi banks – First Abu Dhabi Bank (FAB), Abu Dhabi Islamic Bank (ADIB) and Abu Dhabi Commercial Bank (ADCB) – in coordination with Abu Dhabi Department of Finance and the Abu Dhabi Department of Economic Development, the package is aimed at supporting the community and businesses in Abu Dhabi during the current period of economic uncertainty.

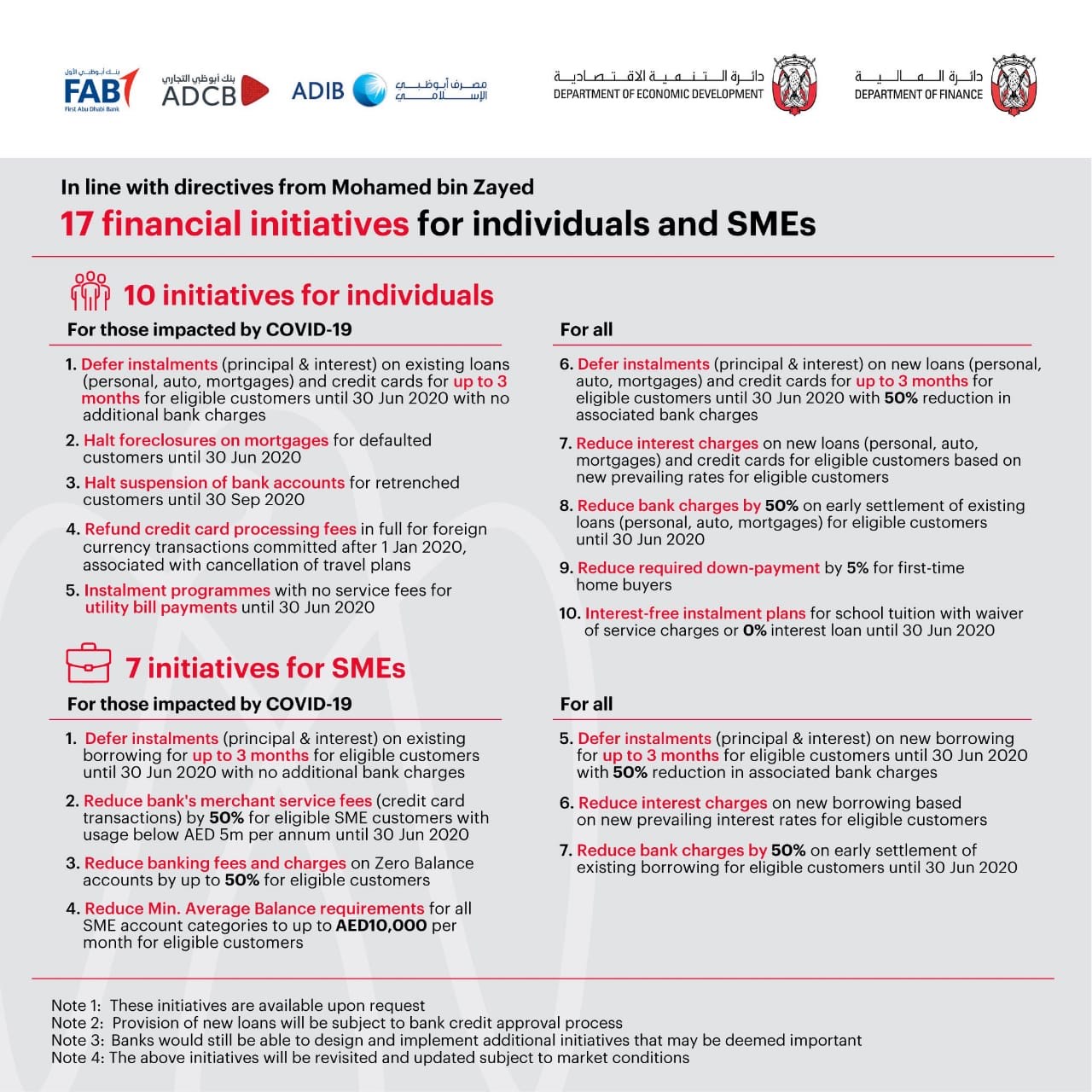

Designed to provide for the immediate needs of individuals and small to medium-sized enterprises (SMEs) in Abu Dhabi, these 17 financial initiatives seek to reduce finance-related costs, facilitate the ease of access to financing, and maintain the resilience of the Abu Dhabi economy. The measures announced today include 10 banking-related initiatives specifically for individuals, and seven financial initiatives for SMEs.

Individuals who are impacted by COVID-19 may obtain these benefits, upon request to their banks. Deferred instalments (principal and interest) of existing personal and auto loans, mortgages, and credit cards will be made available for up to three months for eligible customers until the end of June 2020 with no additional bank charges. Foreclosures on mortgages will be halted for defaulted customers until 30 June 2020 and there will be a halt in the suspension of bank accounts for retrenched customers until the end of September 2020. Full refunds can be obtained on credit card processing fees on foreign currency transactions committed after 1 January 2020, associated with cancellation of travel plans. Lastly, instalment programmes will be made available with no service fees for utility bill payments until 30 June 2020.

All individuals, upon request to their banks, may defer instalments (principal and interest) on new personal and auto loans, mortgages, and credit cards for up to three months for eligible customers until the end of June 2020, along with a reduction of 50% in associated bank charges. To encourage early settlement and refinancing of existing loans, there will be a 50% reduction on associated bank charges for eligible customers until 30 June 2020. In addition, there will be a reduction in interest charges on new loans and credit cards for eligible customers based on new prevailing rates.

For school tuition fees, interest-free instalment plans with either a waiver of service charges or 0% interest loan will also be provided until the end of June 2020. Other measures announced also include reducing the required down-payment by 5% for first-time home buyers.

As for SMEs, the seven measures dedicated to them would enable SMEs to mobilise their borrowings and savings more efficiently, while reducing the financial costs of running their businesses.

For those SMEs who have been impacted by COVID-19, upon request to their banks, they may defer instalments on existing borrowings for three months for eligible customers until the end of June 2020 with no additional bank charges. Eligible SMEs will also be able to save on selected fees for their banking services. Specifically, bank merchant service fees (credit card transactions) will be reduced by 50% for SMEs with below AED 5 million usage per annum until 30 June 2020. There will also be reduction of up to 50% on all banking fees and charges for Zero Balance accounts for eligible customers. In addition, the Minimum Average Balance requirements on all SME account categories will be reduced to up to AED 10,000 per month for eligible customers to provide them with more liquidity.

For all SMEs, upon request to their banks, instalments may be deferred on new borrowings for up to three months along with a 50% reduction in any associated bank charges until the end of June 2020. Eligible SMEs will also benefit from a reduction of interest charges on new borrowings based on new prevailing rates. Lastly, SMEs may avail a 50% reduction in bank charges for early settlements on their existing borrowings until 30 June 2020.

The above initiatives are still subject to the banks’ respective credit approval processes for new loans. FAB, ADIB and ADCB may design and implement additional initiatives that may be deemed as important. All the initiatives stated may be revisited and updated subject to the latest market conditions.