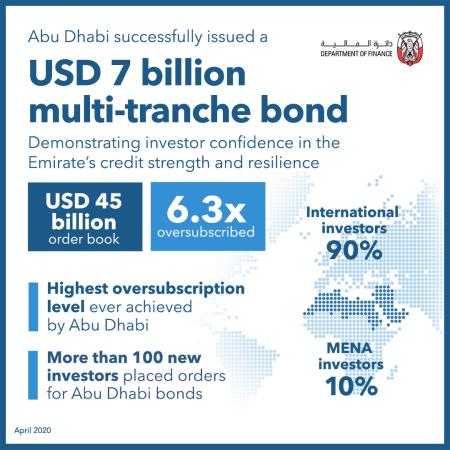

Demonstrating strong investor confidence in its solid credit fundamentals, the Emirate of Abu Dhabi on 8th April 2020 successfully priced a USD 7 billion multi-tranche international bond offering. The transaction comprised of three tranches including a USD 2 billion 5-year tranche, a USD 2 billion 10-year tranche, and a USD 3 billion 30-year tranche.

The offering is part of Abu Dhabi’s medium-term strategy that aims to optimize the capital structure of the Emirate, tapping into diverse funding sources whilst maintaining the current credit ratings.

With orders coming from over 100 new accounts and the orderbook of approximately USD 45 billion, the issuance was more than 6.3 times oversubscribed, marking a record for Abu Dhabi.

The exceptionally strong demand underlines the continued trust in the Emirate’s fiscal strength and resilient balance sheet, which is underpinned by modest levels of debt and a solid asset base, including two of the world’s largest sovereign wealth funds. The 30-year bonds were particularly well received by international investors, who accounted for 98% of the final geographical allocation in this tranche, showcasing trust in Abu Dhabi’s ability to deliver sustained, long-term economic growth.

The tranches priced at 220 basis points over US Treasuries for 5-year bonds, 240 basis points over the same benchmark for 10-year bonds, and 271.1 basis points over US Treasuries for 30-year notes.

Commenting on the offering, His Excellency Jassim Mohammed Buatabh Al Zaabi, the Chairman of the Abu Dhabi Department of Finance, said: “The success of the issuance, particularly amidst the global uncertainties caused by the COVID-19 pandemic and the oil price decline, is testament to the continued confidence placed in our aptitude to generate sustainable economic growth. Our robust credit fundamentals and strong credit ratings with stable outlooks have enabled us to attract remarkable demand from a diverse pool of investors from the international debt capital markets.”

His Excellency continued: “The debt profile of Abu Dhabi continues to be prudent, underscored by low direct Government debt. As a result, we have substantial fiscal flexibility and the capacity to add debt. On that basis, we seized the opportunity to capitalize on the current available market window. Our debt management strategy is a vital component of Abu Dhabi’s economic development and supports the Abu Dhabi Economic Vision 2030.”

Despite a challenging global economic environment, for the year to date, the Emirate of Abu Dhabi remains the tightest priced sovereign from the MENA region.

BofA Securities, Citi, First Abu Dhabi Bank, HSBC, J.P. Morgan, and Standard Chartered Bank were Joint Lead Managers and Joint Bookrunners.