Similar togovernment entities and industry leaders across the world, stakeholders in the Abu Dhabi real estate market have also come together to mitigate the impact of the pandemic on the industry. While the current situation has created unprecedented challenges for the brokerage community, property prices in Abu Dhabi have been largely steady in the first three months of the year as per Bayut’s Q1 market analysis. Freehold investment zones in Abu Dhabi such as Al Reem Island and Al Reef, where prices have mostly remained stable in Q1 2020 compared to Q4 2019, have continued to attract the attention of prospective buyers and investors in the capital. Al Reem Island also recorded the highest value of real estate transactions in 2019 worth AED 6.52B, as per a report by Abu Dhabi’s Department of Municipalities and Transport (DMT).

Properties for Sale in Abu Dhabi

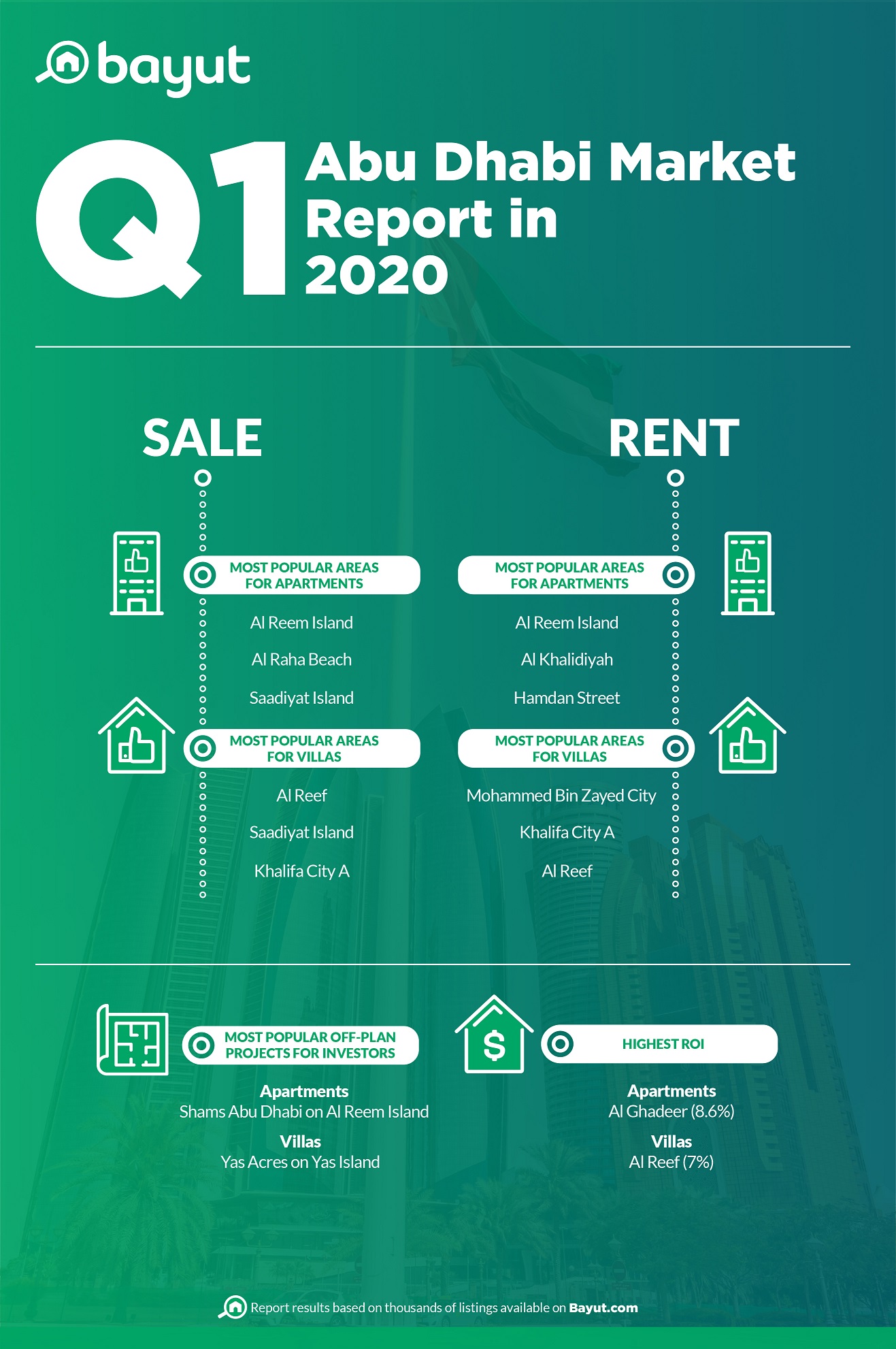

Following on the same lines as the trends observed in 2019, Al Reem Island has remained the most popular choice with buyers and investors interested in apartments for sale in Abu Dhabi in the first quarter of 2020. The average price per square foot in Al Reem Islandhas seen a minor decrease of 2%, going from AED 1,011 in Q4 2019 to AED 911 in Q1 2020.

Other waterfront communities such as Al Raha Beach, Saadiyat Island and Yas Island havecontinued to garner interest from buyers for ready apartments as per Bayut’s Q1 report for Abu Dhabi. The price per square foot for Al Raha Beach has also declined on average by 3.6% from AED 1,271 to AED 1,225 in Q1 2020. On the other hand, Saadiyat Island andYas Island have seen prices remain stable at AED 1,465 and AED 1,336 respectively.

Affordable suburbs such as Al Reef and Al Ghadeer have also drawn interest from buyers and investors keen on affordable apartments in Abu Dhabi.

When it comes to villas for sale in Abu Dhabi, Al Reef has remained the most popular choice with the average price per square foot staying consistent at AED 614.

Other notable areas for villa sales in Abu Dhabi include Saadiyat Island, another neighbourhood where the price per square foot has stayed stable at AED 1,430. Yas Island and Al Raha Gardens haveexperienced a slight increase in price per square in the first quarter of 2020, averaging at AED 846 and AED 773 respectively.

For investors looking to purchase apartments with high return-on-investment in Abu Dhabi, Al Ghadeer has remained the firm favourite with average rental returns up to 8.6%. For villas in Abu Dhabi, Al Reef has remained the best option, with an average ROI of 7%.

When it comes to the off-plan market in Abu Dhabi, freehold island communities such as Yas Island, Al Reem Island and Saadiyat Island have remained the favoured options.Yas Acres in Yas Island has been the most popular choice among prospective buyers interested in off-plan villas in Abu Dhabi while Shams Abu Dhabi in Al Reem Island has been most sought after for off-plan apartments in Q1 2020.

Properties for rent in Abu Dhabi

Al Reem Island has also retained the top spot with potential tenants interested in Abu Dhabi’s apartments as per Bayut’s report. The rental costs in Al Reem Island have remained stable in Q1 2020, averaging at AED 48k for studio apartments, AED 64k for 1-bedroom flats and AED 91k for 2-bedroom units.

The average rental costs in Al Khalidiya, Al Hamdan Street, Khalifa City A and Mussafah have also stayed consistent or experienced a minor uptick in prices for certain bed-types. Other popular areas for rental apartments such as Al Muroor, Al Nahyan and Tourist Club Area have seen minor decreases in rental costs under 5.5% in Q1 2020.

Mohammed Bin Zayed City (MBZ City) has remained the most popular location for rental villas in Abu Dubai in Q1 2020, with average rents holding steady at AED 88k for 3-bedroom villas, AED 123k for 4-bedroom houses and AED 143k for 5-bed units.

Relatively stable suburban areas such as Khalifa City A, Al Reef and Shakhbout City (Khalifa City B) have been the other firm favourites with renters interested in villas in Abu Dhabi.

Haider Ali Khan, the CEO of Bayut and the Head of MENA for EMPG, commented on the performance of Abu Dhabi’s property market: “In the first three months of 2020, before our community was impacted by the unfortunate global incident, the Abu Dhabi real estate market was showing healthy signs of stability which is clearly visible from our Q1 report. The effects of the current situation on consumer interest in the capital’s property market have not been too drastic thanks to the timely measures and economic stimulus packages introduced by the government, and now that the restrictions are easing up further, we’re hopeful things will start going back to normal fairly soon.”

For further details, take a look at the full Q1 2020 Abu Dhabi market report by Bayut.