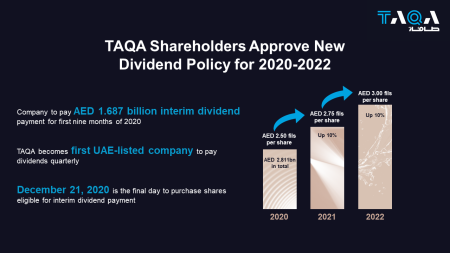

Abu Dhabi National Energy Company PJSC (“TAQA”, the “Company” or the “Group”) – a regionally leading, fully integrated utilities company and one of the UAE’s largest publicly listed companies by market capitalization – announced, today, that its shareholders have approved a new progressive dividend policy for 2020-2022. Further, the Board of Directors have approved an interim dividend payment to shareholders. For the first nine months of 2020, the dividend payment will be AED 1.50 fils per share (AED 1.687 billion in total). This payment will constitute the first portion of the full-year 2020 dividend, which is expected to be AED 2.50 fils per share (AED 2.811 billion in total), which will grow by 10% annually for the following two years (2.75 fils per share for 2021 and 3.00 fils per share for 2022).

Shareholders’ approval occurred at an Extraordinary General Assembly meeting held today. The dividend policy adopted recognizes TAQA’s increased scale and improved financial profile, resulting from its landmark transaction in July with Abu Dhabi Power Corporation (ADPower).

According to the approved policy, dividends for 2020 will be paid through an interim dividend of 1.50 fils per share, which is due to be paid on December 30, 2020, and a final dividend of 1.00 fils per share to be paid after the Annual General Assembly in 2021. Dividends for 2021 and 2022 will be paid quarterly, making TAQA the first UAE-listed company to pay dividends on a quarterly basis.

Following TAQA’s Extraordinary General Assembly meeting, H.E. Mohamed Hassan Al Suwaidi, Chairman of TAQA Group, said: “We are pleased to begin delivery of TAQA’s new strategic imperatives, which include providing attractive and sustainable shareholder returns through the adoption of a new progressive dividend policy and permitting up to 49% foreign ownership of TAQA’s issued capital. These are important steps to diversify the company’s investor base, improve the stock’s liquidity and support the significant efforts of our country’s leadership to encourage foreign capital inflows and position the UAE among the most attractive economies for foreign direct investment.”

Jasim Husain Thabet, TAQA’s Group Chief Executive Officer and Managing Director, commented: “TAQA has maintained its commitment to pay a progressive and attractive dividend to its shareholders as we accelerate our post-integration journey. As TAQA continues to deliver on its core mandate – to supply energy and water reliably and sustainably to those we serve – we will balance funding growth, rewarding our shareholders and upholding our strong credit ratings. Today’s approval for TAQA’s new dividend policy reinforces the Board’s and shareholders’ confidence in the company’s financial strength and predictable cash flow as well as our growth plans for the future.”

Today’s announcement follows the landmark transaction, in July 2020, between TAQA and ADPower, whereby the majority of ADPower’s power and water generation, transmission and distribution assets were transferred to TAQA. The company’s assets, worth approximately AED 191 billion, are located in the UAE, Canada, Ghana, India, Iraq, Morocco, Oman, the Netherlands, Saudi Arabia, the United Kingdom, and the United States.