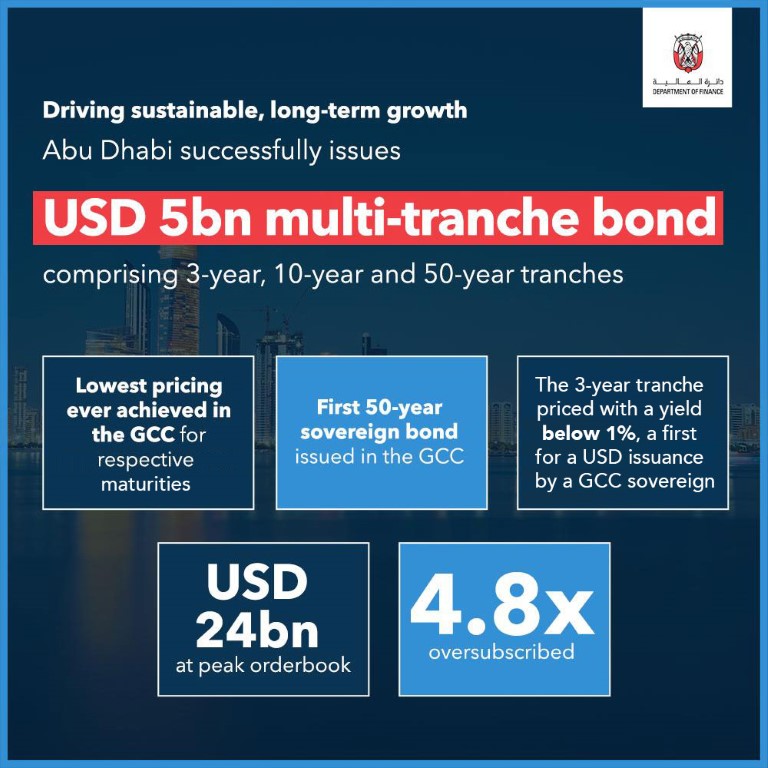

The emirate of Abu Dhabi on 2nd September 2020 successfully completed a USD 5 billion multi-tranche bond offering, which represents a continuation of Abu Dhabi’s commitment to fiscal sustainability.

Underpinned by strong investor appetite, the bonds are priced at historic low yields. The issuance comprises three tranches: a USD 2 billion 3-year tranche, a USD 1.5 billion long 10-year tranche, and a USD 1.5 billion 50-year tranche.

The 50-year tranche is the longest term for a bond issued by a GCC sovereign issuer, which underscores Abu Dhabi’s robust credit fundamentals and the investors’ trust in the emirate’s future economic prospects.

As the only AA-rated sovereign issuer by all three rating agencies in the GCC region, Abu Dhabi’s proactive medium-term debt management strategy optimizes the capital structure of the emirate and taps into diverse funding sources, while maintaining the current credit ratings.

The bond issuance was 4.8 times oversubscribed (at peak orderbook), with orders coming from over 60 new accounts and an orderbook which peaked at USD 24 billion.

The 50-year bonds were particularly well received by international investors, who accounted for 95% of the final geographical allocation, showcasing trust in Abu Dhabi’s ability to deliver sustained, long-term economic growth.

Commenting on the offering, Jassem Mohammed Buatabh Al Zaabi, Chairman of the Abu Dhabi Department of Finance, said: “The success of this bond issuance, in the midst of the Covid-19 global crisis, demonstrates the robust credit fundamentals and more broadly the strength of Abu Dhabi’s economy. The 50-year tranche is a first for not just Abu Dhabi but also for the GCC, and a reflection of formidable investor confidence in our economy, credit strength and long-term outlook.”

He continued: “Abu Dhabi has proven its resilience throughout a global challenging economic period. As the UAE prepares for the next 50 years, through its ‘2020: Towards the next 50’ initiative, we are committed to supporting the wise leadership’s national strategy by instilling a culture of fiscal sustainability.”

The proceeds of the bond issuance will allow Abu Dhabi to focus on sustaining pronounced non-hydrocarbon sector expansion as the emirate continues to diversify its sources of funding and optimize the deployment of government resources to provide continued and sustainable growth.

The tranches achieved unprecedented pricing at 0.83% for 3-year bonds, 1.732% for 10-year bonds, and at 2.7% the 50-year notes.

Citi, Deutsche Bank, First Abu Dhabi Bank, Morgan Stanley, and Standard Chartered were Joint Lead Managers and Joint Bookrunners.