Bayut, the UAE’s leading property portal, has released its Abu Dhabi property market reports for 2022. The data collected by Bayut revealed that sales prices of both affordable and luxury apartments for sale in the capital have continued to rise. When it comes to more spacious, private villas, luxury homes have become more expensive while affordable villas have become more competitively priced. In contrast, prices for rental apartments and villas have generally decreased across Abu Dhabi’s most popular districts, with the only notable exception seen for luxury villa rentals.

- As per Bayut’s property market reports for 2022, the sales prices for villas have declined by up to 18%, while the cost of apartments has increased by up to 2.71% in the affordable segment. Prices for luxury properties have reported surges of up to 13% for both apartments and villas.

- On the other hand, rental prices have declined by up to 9% for apartments, with villa rentals reporting increases of up to 12% in the affordable segment. Prices for luxury rentals have decreased by up to 15% for apartments and up to 29% for villas.

- Prospective investors have preferred affordable suburbs like Al Reef and Al Ghadeer to buy apartments, whereas waterfront communities like Al Reem Island, Al Raha Beach, Yas Island andSaadiyat Island have attracted buyers interested in luxury units.

- Those interested in buying competitively priced villas have gravitated towards Al Reef, whereas affluent communities like Saadiyat Island, Yas Island and Al Raha Gardens have been investment hotspots for high-income buyers.

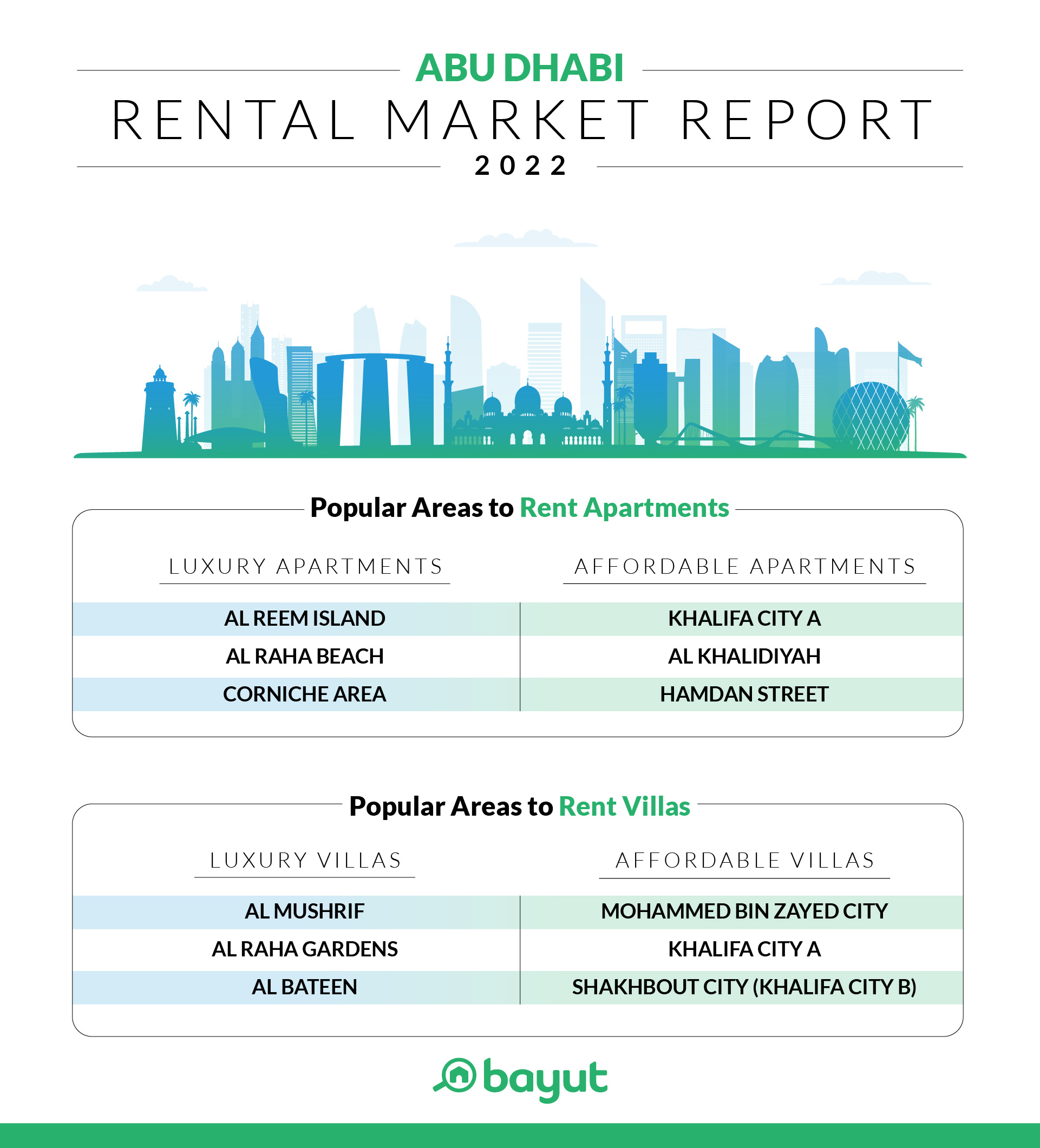

- Tenants on a budget have preferred established communities like Khalifa City A and Al Khalidiyah to rent apartments. Waterfront districts like Al Reem Island and Al Raha Beach have continued to be popular amongst those seeking luxury flats in Abu Dhabi.

- Mohammed Bin Zayed City has been the most sought-after area to rent affordable villas in Abu Dhabi, whereas Al Mushrif has captured the interest of higher-income tenants.

Properties For Sale in Abu Dhabi

Villas

Saadiyat Island has garnered the most consumer interest for luxury villas in Abu Dhabi:

- The average price-per-square-foot for villas in Saadiyat Island has experienced an appreciation of 12.7%, increasing from AED 1,438 in 2021 to AED 1,620 in 2022, pointing towards a steady demand for waterfront properties.

- Similarly, the price-per-square-foot for houses in Yas Island have increased by 6.1%, averaging at AED 1,144 in 2022.

- In contrast, the average sales price-per-square-foot for houses in Al Raha Gardens have experienced a slight decrease of 0.49%, to stand at AED 834in 2022.

As per the data collected by Bayut, Al Reef has been the most popular choice for affordable villas during 2022:

- The average sales price-per-square-foot for houses in Al Reef witnessed an increase of 4.67% during 2022, rising from AED 675 in 2021 to AED 707 in 2022.

- Additionally, price-conscious investors have favoured areas such as Khalifa City A, Hydra Village, Al Ghadeer and Baniyas to buy cheap houses in the capital. Among these areas, houses in Baniyas have reported a significant decrease of 18% in average price-per-square-foot. This price shift can be explained by a rise in the area’s low-priced inventory of properties, particularly inBawabat Al Sharq.

Apartments

In 2022, prospective investors have been drawn towards waterfront and island communities to buy upscale apartments in Abu Dhabi:

- Al Reem Island has been the top choice for luxury apartment buyers in Abu Dhabi. The apartments in Al Reem Island have recorded a minor increase of up to 2% in price-per-square-foot, averaging at AED 1,011 in 2022.

- Buyers have also preferred Al Raha Beach, Yas Island and Saadiyat Island for luxury apartments. These areas have recorded increases of up to 14% in average price-per-square-foot during 2022. Apartments in Saadiyat Island have reported the highest increase – 13.2% – which could be attributed to the price shift consequent to the increased inventory inPark View, Saadiyat Cultural District andSoho Square.

For affordable apartments in Abu Dhabi, buyers have mostly favoured suburban communities:

- Al Reef has been the first choice for investors interested in buying flats in the budget category. The price-per-square-foot for apartments in Al Reef has increased by 2.71%, to average at AED 686 in 2022.

- Al Ghadeer has also appealed to budget-conscious buyers during 2022. The average price-per-square-foot for flats in Al Ghadeer has increased marginally by less under 1%, averaging at AED 703.

- Apartments in Baniyas have reported a 2.95% decrease in sales price-per-square-foot, reducing from AED 769 in 2021 to AED 746 in 2022.

- The sales price-per-square-foot for flats in Masdar City has increased marginally by 0.48% to averageat AED 1,196 in 2022.

Rental Yields in Abu Dhabi

- In 2022, Al Reef has offered the highest projected ROI of 7.77% for affordable apartments, whereas properties in Al Reem Island have reported impressive rental yields of 6.65% in the luxury segment.

- Hydra Village has recorded the highest ROI of 6.71% for budget-friendly villas, while Al Raha Gardens has offered healthy rental returns of 6% for luxury houses in Abu Dhabi.

Off-Plan Projects in Abu Dhabi

- Oasis Residences in Masdar City has emerged as the most popular project to buy off-plan apartments in the affordable segment, with Yas Bay in Yas Island appealing to High-Net-Worth (HNW) investors.

- Buyers on a stricter budget have preferred Noya in Yas Island to purchase reasonably-priced villas in Abu Dhabi, while Yas Acres has appealed to high-income investors.

Properties For Rent

Villas

According to the trends observed by Bayut, Mohammed Bin Zayed City (MBZ) has been the top choice for affordable villa rentals in Abu Dhabi:

- The asking rents for 3-bed houses in MBZ City have decreased by 7.36%, whereas the cost of 5-bed villas have slightly increased by up to 1%. The rental prices for 4-bed houses in MBZ City remain unchanged. The rental costs forvillas in MBZ City have averaged at AED 93k for 3-bed houses, AED 128k for 4-bed homes and AED 147k for 5-bed residences.

- Tenants have also shown interest towards other prominent communities in Abu Dhabi like Khalifa City A, Al Reef, Shakhbout City (Khalifa City B), Al Shamkha South andShakhbout City (Khalifa City B). Properties in these areas have generally reported appreciations of up to 12% in their average prices. The rent for 4-bed homes in Shakhbout City (Khalifa City B) have, however, decreased by 6.26%, whereas no change was observed in the asking rents for 4 and 5-bed villas in Al Reef.

When it comes to luxury villas, Al Mushrif has retained its standing as the most popular area in Abu Dhabi, reporting increases of up to 11% in rental costs:

- 4-bed houses in Al Mushrif have been priced at AED 180k, whereas the asking rents for 5-bed houses have averaged at AED 204k. The 6-bed houses have become slightly more expensive, averaging at AED 218k in 2022.

- Apart from Al Mushrif, tenants looking for expensive villas have turned towards upscale areas like Al Raha Gardens, Al Bateen, Yas Island, and Al Raha Beach in 2022. The asking rents in these areas have increased by up to 29%, with the most significant uptick observed for 5-bed homes in Al Raha Beach. This could be due to landlords listing their properties at a higher price range to capitalise on the area’s increasing demand.

Apartments

When it comes to apartments, Khalifa City A has emerged as the most popular area to rent affordable flats in Abu Dhabi:

- The average rents for studios and 1-bed apartments in Khalifa City A have remained unchanged, whereas the cost of 2-bed flats have dropped by 3.18%. The average rents for studios in Khalifa City stood at AED 28k, whereas the cost of 1 and 2-bed flats have averaged at AED 42k and AED 61k respectively.

- Apart from these areas, tenants searching for cheaper apartments have shown an inclination towards older, family-friendly districts like Al Khalidiyah, Hamdan Street, Al Muroorand Tourist Club Area, where average rents have generally declined from between 2% and 9%.

On the luxury front, Al Reem Island has garnered maximum consumer interest for renting upscale apartments in 2022, exhibiting an increase of up to 2.12% in average rents:

- The rental asking prices for flats in Al Reem Island have shown increases across the board, with 1-bed apartments averaging at AED 59k, 2-bed flats at AED 87k and 3-bed apartments for AED 128k.

- Other areas that have appealed to tenants include Al Raha Beach, Corniche Area, Yas Island and Corniche Road. Among these districts, Al Raha Beach has reported the highest decrease in average rents – 14.4% – a price shift likely caused by landlords pricing their properties competitively to attract tenants.

Commenting on the trends, Haider Khan, the CEO of Bayut&dubizzle and head of EMPG MENA said;

“The overall stability of the capital city’s economy has continued to make it a destination of choice among property buyers interested in the region. In the last two quarters of 2022, there was a significant increase in both volume and value of sales transactions based on the data released by DARI. The value of transactions in Abu Dhabi increased by well over 60% in Q4 2022, which is a clear indication of the rising demand for real estate in the capital, and is also evident by the growing traffic of over 12M sessions on our portal over the course of the last year for listings in Abu Dhabi alone.

With the market firmly on a growth trajectory, we can expect more need for transparency and digitisation. The government in the capital is already proactively preparing for this and has taken the first steps with the launch of DARI in February 2022. As the leading portal in the region, we will continue to provide the necessary support to all stakeholders as we move towards a more transparent, regulated ecosystem.”